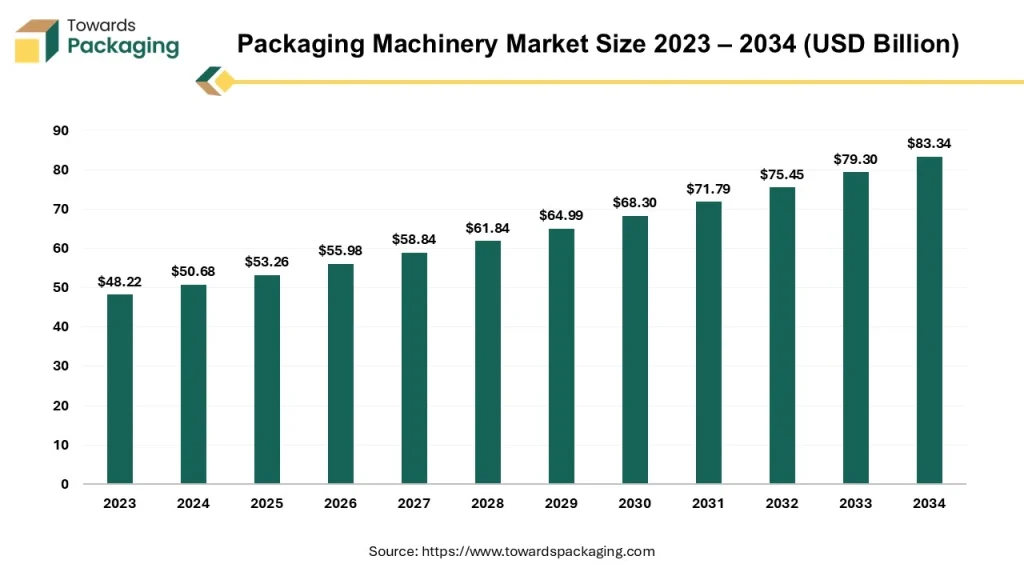

The global packaging machinery market is on a promising growth trajectory, with projections indicating a rise from USD 50.68 billion in 2024 to USD 83.34 billion by 2034, marking a CAGR of 5.1%. With innovations transforming packaging operations and demand accelerating from diverse sectors, the industry is experiencing rapid evolution.

Market Overview: The Surge of Automation and Customization

Packaging machinery plays a crucial role in ensuring goods are efficiently packed, preserved, and presented for commercial and logistical purposes. From bottling and sealing to coding and shrink wrapping, these machines enable businesses to optimize output, reduce labor costs, and maintain product integrity.

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/download-databook/5115

The sector witnessed a notable 13% surge in 2022, driven by pandemic-induced investments in production and supply chain upgrades. This resilience underscores the sector’s capability to adapt to evolving challenges and maintain robust growth.

Regional Spotlight: Asia-Pacific Leads the Way

🌏 Asia-Pacific

The region, particularly China and India, dominates the packaging machinery landscape. A booming population, expanding middle class, and a spike in e-commerce demand are key growth enablers. The region’s focus on eco-friendly materials, flexible packaging formats, and smart technologies like QR codes and augmented reality are propelling the need for next-gen machinery.

🇨🇳 China’s Innovation Drive

China’s “Made in China 2025” initiative has brought packaging innovation to the forefront. With investments in IoT-enabled, automated, and robotic machinery, Chinese manufacturers are becoming competitive on a global scale. Exports surged by 40% as domestic firms began offering high-tech machines at competitive prices.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardspackaging.com/download-sample/5115

Smart Trends Shaping the Industry

🔧 Smart Packaging Machines

Machines now feature self-diagnostics, predictive maintenance, and performance learning, reducing downtime and ensuring consistent product quality.

🧠 AI & Automation

AI-driven systems predict potential faults and adjust operations in real-time. These capabilities help companies reduce waste and improve throughput.

🌱 Sustainable Packaging

As sustainability gains priority, manufacturers are aligning with green regulations and shifting towards biodegradable and recyclable packaging, pushing demand for compatible machinery.

📶 IoT Integration

IoT-enabled machines collect data at every packaging stage, allowing better performance monitoring, reduced waste, and quicker delivery cycles.

Key Segment Focus: The Critical Role of Filling Machines

Filling machines have emerged as a linchpin in the packaging ecosystem. Whether it’s beverages, cosmetics, or chemicals, these machines offer:

-

Precision dosing

-

Adaptability across formats

-

High-speed operations

-

Support for aseptic and hot filling technologies

Technological upgrades like servo motors and automatic changeovers are further enhancing productivity and minimizing downtime.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

North America: Technological Backbone of the Industry

The North American market has embraced automation to meet growing demands for precision and compliance. In 2022, machinery shipments rose by 12.4% to USD 10.2 billion, with innovations driving investment in smart and modular machines.

Despite short-term pandemic backlogs, the long-term outlook remains solid due to increased adoption of end-of-line packaging systems and efficiency-focused upgrades.

Market Drivers, Restraints, and Opportunities

✅ Demand Drivers

-

Automation for optimized productivity

-

Demand for smart, eco-friendly solutions

-

Growth in food & beverage, pharmaceutical sectors

⚠️ Market Restraints

-

High cost of advanced packaging machinery

-

Limited access for small and medium enterprises

🚀 Growth Opportunities

-

Customized, sector-specific packaging machinery

-

Export potential for low-cost, high-efficiency equipment

Technological Boost in Productivity

Recent studies reveal a 7.9% increase in labor productivity and 6.8% rise in multifactor productivity in packaging operations. Over 89% of businesses now actively measure and enhance productivity, indicating widespread commitment to innovation-led growth.

Competitive Landscape: Leading Players and Strategic Moves

Key players shaping the global packaging machinery space include:

-

Tetra Laval International S.A.

-

MULTIVAC Group

-

FujiMachinery Co., Ltd.

-

ProMach

-

Krones AG

-

SIG Combibloc Group Ltd.

-

Syntegon Technology GmbH

-

Bradman Lake Ltd.

These players are investing in sustainability, digital integration, and global expansion.

Recent Highlights:

-

Packsize (March 2025): Launched X6 automated right-sized packaging system.

-

AstroNova (April 2025): Introduced advanced digital printer presses at FESPA.

-

IMA Group (April 2025): Showcased tailored lines for Tissue & Nonwoven at IDEA 2025.

-

CMC Packaging (Dec 2024): Unveiled compact machine packing up to 500 units/hour.

-

Comexi (July 2023): Opened new factory in Bangkok to strengthen APAC presence.

Final Thoughts

The packaging machinery market is poised for a decade of innovation, efficiency, and global expansion. As automation, sustainability, and consumer expectations evolve, so too will the machinery that powers this crucial industry.

Stay updated on trends and opportunities — the future of packaging is smarter, faster, and greener.

Source : https://www.towardspackaging.com/insights/packaging-machinery-market-sizing