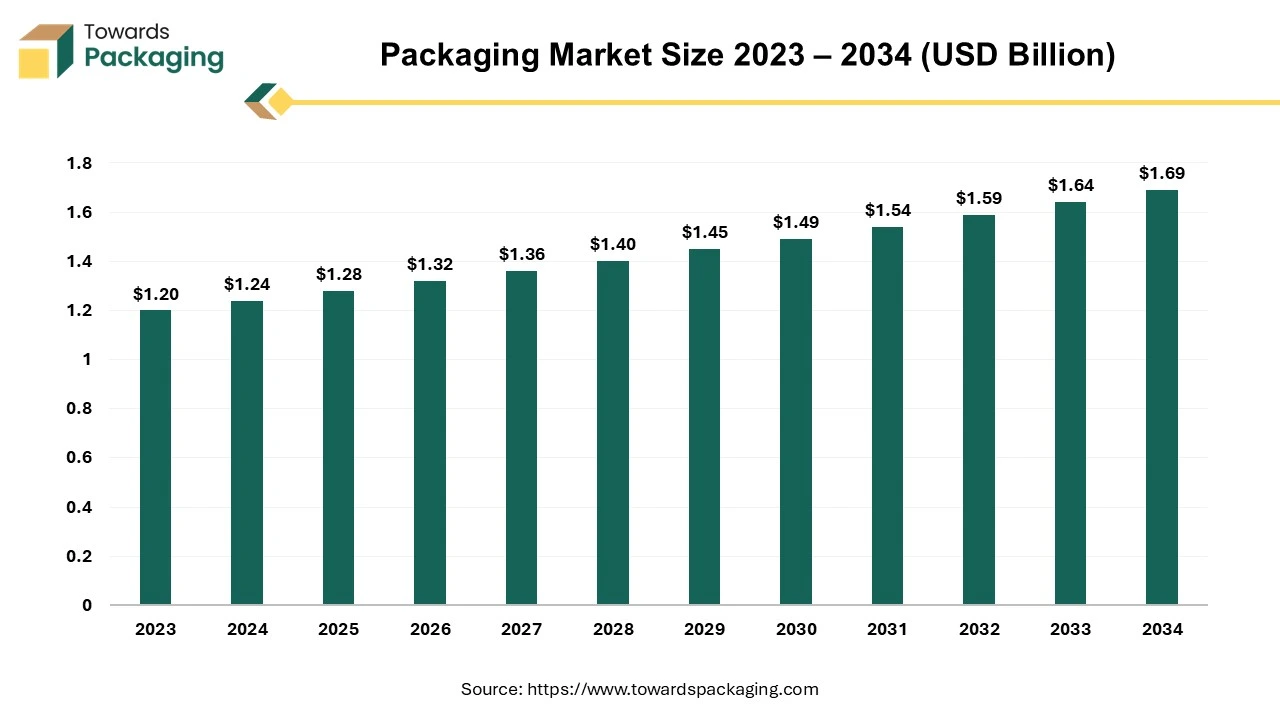

The global packaging market reached a size of USD 1.24 trillion in 2024 and is projected to grow to USD 1.69 trillion by 2034, expanding at a compound annual growth rate (CAGR) of 3.16% from 2025 to 2034. As packaging evolves from being a simple protective layer to a multifunctional element in product strategy, industries worldwide are witnessing rapid innovations in materials, technologies, and sustainability practices.

Key players in the packaging industry are focusing on inorganic growth strategies—such as mergers, acquisitions, and partnerships—to develop advanced technologies like plant fiber-based packaging, enabling businesses to meet consumer demand for eco-friendly solutions.

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/download-sample/5140

Market Overview: Packaging as a Driver of Product Safety and Sustainability

Packaging serves multiple roles:

-

Protection during storage, transportation, and handling.

-

Communication of brand identity and critical product information.

-

Convenience for consumers through innovative designs.

-

Sustainability, addressing environmental concerns with eco-friendly solutions.

As industries shift toward circular economy models, packaging innovations now emphasize recyclable, biodegradable, and reusable materials. Digital technologies, such as smart packaging and AR integration, are redefining how packaging connects with consumers.

If there’s anything you’d like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Key Market Insights

-

Market Size: USD 1.24 trillion in 2024; projected to reach USD 1.69 trillion by 2034.

-

Growth Rate: CAGR of 3.16% (2025–2034).

-

Regional Highlights:

-

Asia Pacific dominated the market in 2024.

-

North America is expected to experience significant growth during the forecast period.

-

-

By Material: Paper and paperboard led the market in 2024.

-

By Packaging Type: Rigid packaging held the largest market share in 2024.

-

By Printing Technology: Flexography dominated in 2024.

-

By End User: Food & beverages was the leading segment in 2024.

Three Eras of Packaging Transformation

Era 1 (2000–2009): Substrate Shift Changes

-

Shift from rigid materials (glass, metal) to flexible packaging.

-

Growth in demand for smaller packs driven by snacking culture and convenience.

-

Rapid market expansion in Asia; creation of global corporations.

Era 2 (2010–2020): Changing Consumer Preferences

-

China emerged as the largest packaging market.

-

Surge in e-commerce and heightened environmental awareness.

-

Innovation in high-functionality packaging and pilot projects in sustainable materials.

-

Industry consolidation and strong private equity activity.

Era 3 (2020–Present): Sustainability and Digital Transformation

-

Strong consumer push for sustainability and eco-friendly solutions.

-

Digital printing technologies enabling customization and shorter production runs.

-

Rise of reusable/refillable packaging systems and smart packaging with QR codes, AR, and RFID.

Key Market Trends Driving Growth

-

Sustainability and Eco-Friendly Materials

-

Adoption of biodegradable plastics, plant-based polymers, and paperboard solutions.

-

Increasing popularity of minimalistic designs and packaging with a reduced environmental footprint.

-

-

Smart and Connected Packaging

-

Use of sensors, RFID, and QR codes for real-time monitoring and traceability.

-

Interactive experiences for consumers via AR-enabled packaging.

-

-

Flexible Packaging Demand Surge

-

Bags, pouches, sachets, and wraps gaining traction for their portability and lower material usage.

-

-

Security-Enhanced Packaging

-

Incorporation of tamper-evident seals, holographic labels, and track-and-trace technologies to combat counterfeiting and ensure product integrity.

-

-

Regional Customization

-

Packaging designs tailored to cultural preferences and environmental awareness levels in different regions.

-

In-Depth Market Segmentation

By Material

-

Paper & Paperboard

-

Folding cartons, corrugated boxes, and boxboard.

-

Biodegradable and recyclable, driving sustainability initiatives.

-

-

Plastics

-

PET, HDPE, LDPE, and bio-based plastics for flexible and rigid applications.

-

-

Glass

-

Preferred for premium and reusable packaging, especially in food, beverages, and cosmetics.

-

-

Metal

-

Aluminum and tin used in cans, closures, and high-barrier applications.

-

By Packaging Type

-

Rigid Packaging

-

Bottles, cans, jars, and trays offering superior protection and durability.

-

-

Flexible Packaging

-

Pouches, wraps, and films gaining traction for portability and reduced material use.

-

By Printing Technology

-

Flexography (dominant in 2024)

-

Cost-effective for large production runs.

-

-

Digital Printing

-

Rapid growth due to customization capabilities and shorter lead times.

-

-

Offset Printing

-

Preferred for high-quality graphics in premium packaging.

-

By End User

-

Food & Beverages (largest segment in 2024)

-

Includes fresh produce, packaged foods, and beverages requiring safe and sustainable packaging.

-

-

Healthcare

-

Demand for sterile and tamper-proof packaging solutions.

-

-

Personal Care & Cosmetics

-

Emphasis on premium, eco-friendly designs.

-

-

Consumer Electronics

-

Protective packaging solutions to prevent damage during transit.

-

-

Industrial Goods

By Region

-

Asia Pacific: Largest market share in 2024, driven by population growth and rising consumption.

-

North America: Growth driven by sustainability regulations and e-commerce expansion.

-

Europe: Strong focus on circular economy initiatives and premium packaging solutions.

-

Latin America: Emerging demand for cost-effective and eco-friendly packaging.

-

Middle East & Africa: Growth supported by urbanization and increasing demand for consumer goods.

Leading Companies in the Global Packaging Market

-

International Paper Company

-

Clearwater Paper Corporation

-

Shandong Bohui Paper Company Ltd

-

Mondi Group

-

ITC Ltd

-

DS Smith Plc

-

Smurfit Kappa Group Plc

-

WestRock Company

-

Svenska Cellulosa Aktiebolaget (SCA)

-

Oji Holdings Corporation

-

Nippon Paper Industries Co. Ltd

-

South Africa Pulp and Paper Industries Ltd

These companies are focusing on:

-

Expanding production capacities for plant-based and recyclable materials.

-

Mergers and acquisitions to strengthen market presence.

-

Investing in R&D for biodegradable and smart packaging solutions.

Future Outlook: Building a Resilient, Sustainable Packaging Ecosystem

The global packaging industry stands at a critical inflection point, where sustainability and digital transformation are no longer optional but strategic imperatives. Companies that innovate with eco-friendly materials, scalable digital technologies, and consumer-centric designs will lead the market.

The next decade will witness:

-

Wider commercialization of reusable and refillable packaging models.

-

Integration of smart technologies for supply chain visibility.

-

Stronger regional focus on customized packaging solutions.

With packaging at the heart of product safety, branding, and environmental stewardship, the industry’s role in shaping global consumption patterns is more pivotal than ever.

Source: https://www.towardspackaging.com/insights/packaging-market-sizing